2020 tax estimator

Estimate Your Refund with the Tax Refund Calculator and Estimator. Include your income deductions and credits to calculate.

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

HR Block does not provide audit attest or.

. You are eligible for the Middle Class Tax Refund if you. View this and more full-time part-time jobs in Los Angeles CA on Snagajob. Required Field California taxable income Enter line 19 of 2021 Form 540 or Form 540NR Caution.

If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied. Apply for a Amtec Estimator job in Los Angeles CA. The bill preserves seven tax brackets but changes the rates that apply to.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Based on your projected tax withholding for. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

File 2020 Taxes With Our Maximum Refund Guarantee. 2020 Simple Federal Tax Calculator. All Available Prior Years Supported.

After You Use the Estimator. Easy Fast Secure. This page has the latest California brackets and tax rates plus a California income tax calculator.

And is based on the tax brackets of 2021 and. Income tax tables and other tax. Use your estimate to change your tax withholding amount on Form W-4.

Ad With TurboTax Its Fast And Easy To Get Your Taxes Done Right. Filed your 2020 tax return by October 15 2021. Offer valid for returns filed 512020 - 5312020.

2020 Tax Calculation for 2021 Refund. Based on your projected tax withholding for the. Your household income location filing status and number of personal.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Dont Put It Off Any Longer. Use your income filing status deductions credits to accurately estimate the taxes.

If the return is not complete by 531 a 99 fee for federal and 45 per state return will be applied. Use the 540 2EZ Tax Tables on the Tax. Ad File prior year 2020 taxes free.

Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020. Your household income location filing status and number of personal. Pays for itself TurboTax Self-Employed.

1040 Tax Estimation Calculator for 2020 Taxes Enter your filing status income deductions and credits and we will estimate your total taxes. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The tax bill will lower many individual rates.

More In-Depth TY2020 Estimator. To change your tax withholding amount. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. Meet the California adjusted gross income CA AGI limits described on the Middle Class. This calculator does not figure tax for Form 540 2EZ.

Coronavirus Aid Relief and Economic Security CARES Act permits self-employed individuals making estimated tax payments to defer the payment of 50 of the social security tax on net. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020.

Pays for itself TurboTax Self-Employed. Get Previous Years Taxes Done Today With TurboTax. Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try.

It is mainly intended for residents of the US. Do Your 2021 2020 any past year return online Past Tax Free to Try. HR Block does not provide audit attest or.

Or keep the same amount. Easy Fast Secure. 10 12 22 24 32.

Use the PriorTax 2020 tax calculator to find out your IRS tax refund or tax due amount. Californias 2022 income tax ranges from 1 to 133. Offer valid for returns filed 512020 - 5312020.

Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. Free preparation for 2020 taxes.

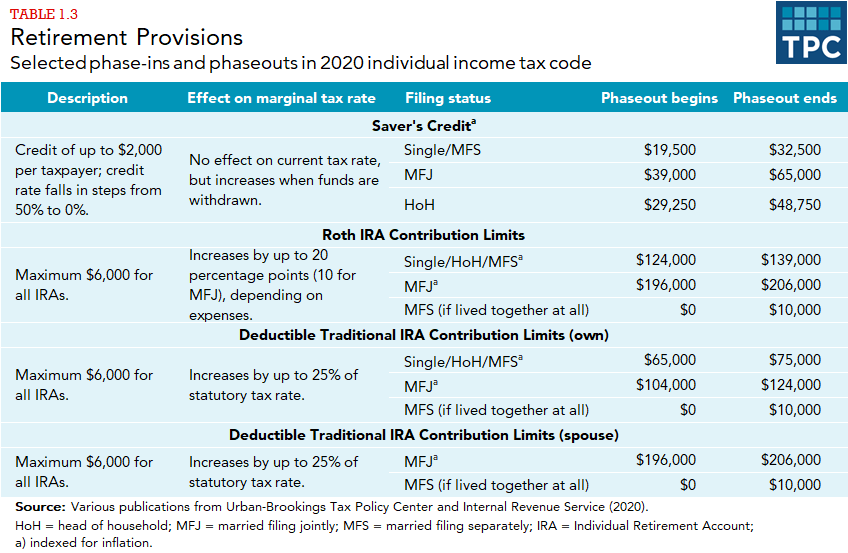

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

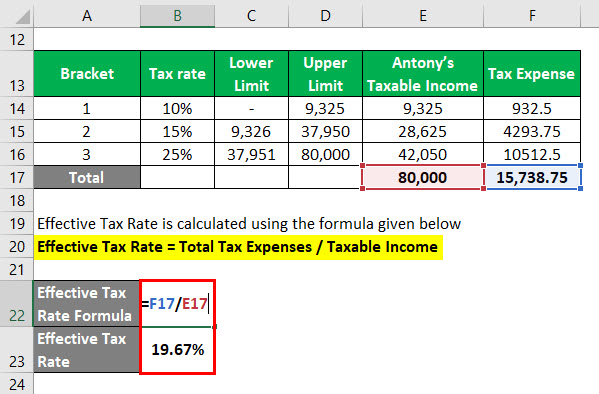

How To Calculate Income Tax In Excel

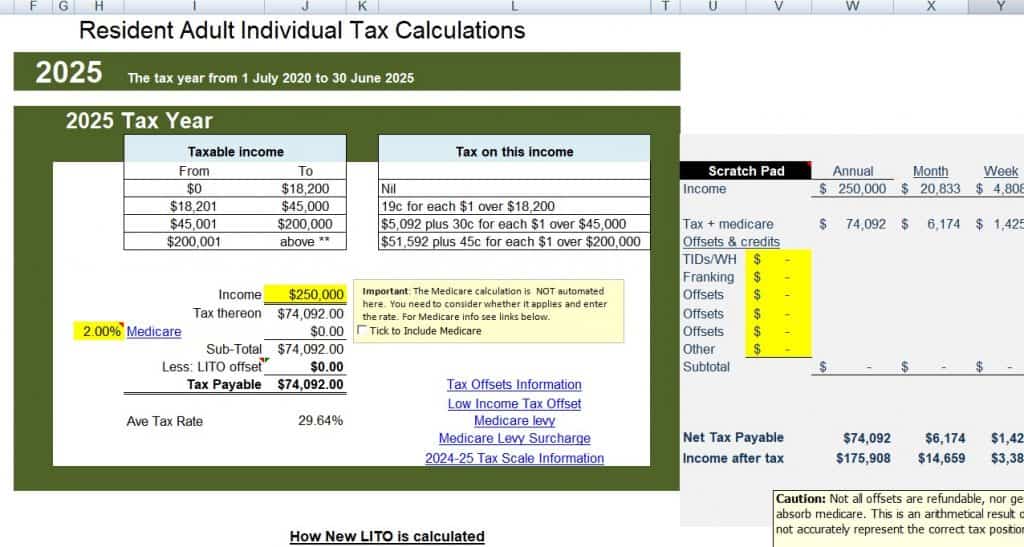

Australian Tax Calculator Excel Spreadsheet 2022 Atotaxrates Info

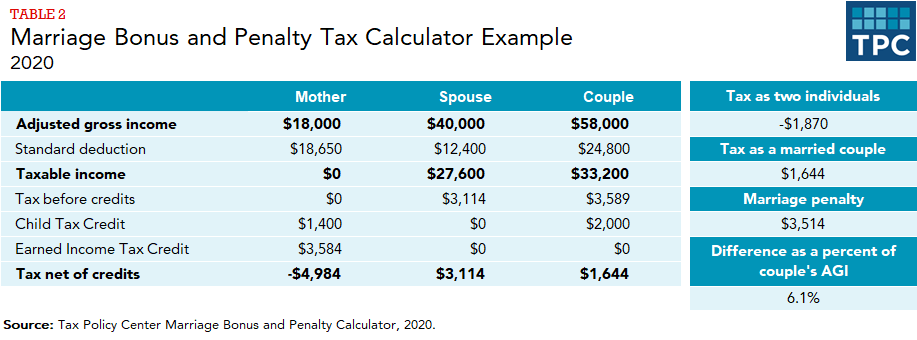

What Are Marriage Penalties And Bonuses Tax Policy Center

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Effective Tax Rate Formula Calculator Excel Template

Tax Calculator Estimate Your Income Tax For 2022 Free

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Average Tax Rate Definition Taxedu Tax Foundation

How To Calculate Federal Income Tax

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Calculate Federal Income Tax

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

How To Calculate Income Tax In Excel